What you need to know about the Global Capital Investment

First time on our platform click below ⬇️

BRINGING FAMILIES ALONG

A Message From Our Founders

“The rise of crypto has been social, emotional, and collaborative. That ethos is deeply aligned with how we envision the experience of wealth creation. Unfortunately, a lot of people have felt totally left behind by this movement. As the investing landscape changes, it’s our job to help families evolve alongside it.

That’s why we are thrilled to announce EarlyBird Crypto. With simplified access, security, and education, we can invite all families to participate in the present, and future, of wealth-building.”

REGISTER BELOW ⬇️

GLOBAL CAPITAL INVESTMENT

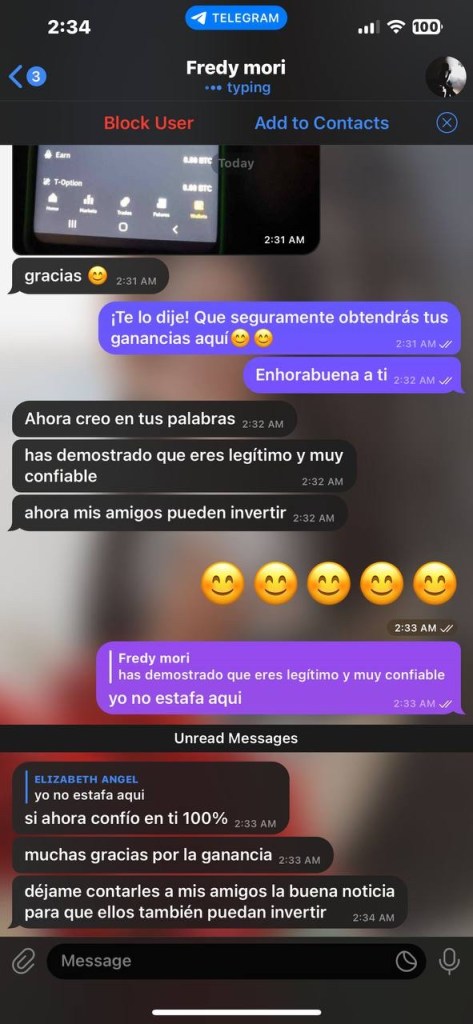

TESTIMONIES OF WINNINGS FROM OUR MEMBERS SO GLAD 🎖️🏆💰💸🎊

INVESTMENT ADVICE

Investment advice is professional guidance that informs consumers on financial matters or products. Investment advice shouldn’t be given — or taken — lightly, and if a single piece of information were the best fit for everyone, we’d all be Warren Buffett rich by now.

Only registered investment advisors can legally give investment advice — they are registered with either the U.S. Securities and Exchange Commission or their state’s securities regulator. Need investment advice from a specialist? Jump to online financial planning services.

Absent magic advice that applies to everyone, there are still some general rules of thumb. We asked financial advisors to share their best investment advice. Here’s what they had to say.

MEMBERS OF GLOBAL CAPITAL INVESTMENT 🔰

What a team work means

Teamwork in the workplace is when a group of individuals works together toward a collective goal in an efficient manner. When multiple people work together toward a common goal, your business can flourish.

Global Capital Investment

Simply put, Global Capital Markets are a place where savings meet investment. In many cases, the form of capital is savings by private individuals. Similarly, capital can come from pension funds, hedge funds and other interest seeking entities. The investment opportunities come in two forms; Equity Capital and Debt Capital. Capital markets consist of the primary market, where new securities are issued and sold, and the secondary market, where already-issued securities are traded between investors. The most common capital markets are the stock market and the bond market. When a company wants to raise equity, we talk about ECM – Equity Capital Markets. When a company wants to raise debt, we talk about DCM – Debt Capital Markets.

Going Public in the Equity Capital Markets?

Going public is a critical moment in the life of any company this means it has grown from a small business to a large entity – ready to get public investors onboard in the ECM. The company shares will be sold to public investors and they can determine who will run the business and who will sit on board of directors. This is a very complex processes that must be carried out at the right time. The founders of the company want it to be sold at the right price and monetise their hard work. At the same time public investors are interested in making an investment in a company with great management and a great growth potential.

The Company going public must increase its administrative and finance staff significantly. It will have to prepare several documents and financial reports not required for private firms this is a cost it will have to bear. Timing plays a critical role in the initial public offering (IPO) must be carried out at the right moment. The company must be ready in size, profitability administrative capacity, growth potential and investors must be convinced that their money is in good hands.

Contact us below for more information Thanks for your time.

📩EMAIL US

SOLOWEST92@GMAIL.COM

🏪FIND US

HTTPS://GOO.GL/MAPS/TETTV8SKDLV8J1GS8

2023© Global Capital Investments LLC